Grants and Loans

MEDIA

SBIF Success!!! $2.4 million in funding

Seventeen Greater Chatham building owners and businesses selected for $2.4M in city grants https://chicago.suntimes.com/small-business/2025/02/20/greater-chatham-businesses-chicago-improvement-fund-grants The 17 grant recipients can use the funds for building improvements and repairs.

To fully access the article there is a 30 sec video then scroll down past the donations to proceed to the full article.

In the last four years GCI has assisted with 152 grant and loan applications for a total value of $29.6 million. Over half, 80 were successful in being selected totaling $9.8 million.

2023 Chicago Sun-Times FoodLab article: FoodLab Chicago Sun-Times Feb 19th 2023

Soul Delivered – locally owned, community delivery services

Caterers – You do the cooking, leave the delivery to Soul Delivered

Soul Delivered, a community delivery service to South Side neighborhoods 51st to 95th, Western Ave to the Lake. Providing businesses an affordable delivery option. Locally owned, social enterprise teaching businesses financial analysis to increase revenue and profits. Helping to develop their staffs for a higher productivity operation and output. Guiding the business’s digital presence with website development, online ordering, social media marketing, and patron database development

higher productivity operation and output. Guiding the business’s digital presence with website development, online ordering, social media marketing, and patron database development

If every plate is profitable, then the food business will be profitable.

FoodLab Chicago 6.0 now in session

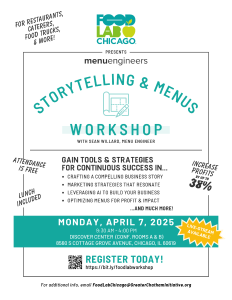

Menu Engineering & Storytelling event:

Monday April 7th 2025 9:30am – 4:00pm

Discover Center, 8460 S Cottage Grove Ave

watch for more information

Free. And limited, free one-on-one consulting available.

Open to all food service providers – restaurants, caterers, foodtrucks. Also available a limited number of free one-on-one menu consultations.

Bonus : After lunch, panel discussion on deportation threats impact on customers go out to restaurants and going to work at the restaurants. Scenario Planning on customer, staffing and raising food prices on local food service.

Flyer : FLC April 7th Storytelling FLC Aprl 7th Storytelling

What is Menu Engineering?

Menu engineering is part science, part art. By utilizing data, research, and industry knowledge, restaurateurs and operators can make impactful decisions on their menus to produce specific, measurable results in profitability and guest satisfaction.

Simply put, Menu Engineering is how we build powerful and profitable menus!

Source: https://www.menuengineers.com/

What will you learn?

- Menu Trends

- Menu Engineering Principles & Our Circular Development Cycle

- The Growth-Share Matrix

- Item Pricing & Positioning

- Menu Update Planning

- Menu Strategies & tactics to drive sales and profits

Why is Menu Engineering important?

- Ongoing menu engineering has the potential to increase restaurant profits by 10-15%

(source: Menu Cover Depot)● Highlights your more profitable menu items - Eliminating poor-performing items from the menu, helping your food costs

- Improves customer satisfaction

Selected FoodLab Chicago Alumni using menu engineering techniques have increased their revenues from 3% to 38%

FLC April 7th Storytelling Flyer

FoodLab Chicago 6.0 is an insightful, educational program designed for food based businesses who are looking to take their businesses to the next level.

Since its launch, FoodLab Chicago has assisted 85 Black-owned South Side Chicago businesses. Selected participants have acquired over $6.6 million in grants and loans and increased their profits with menu engineering from 3% to 38%.

FoodLab Chicago seeks to support Black and Brown food service entrepreneurs who have been operating for at least 18 months and are located in Chicago.

Attend weekly in-person sessions each Monday from 9:00 am to 12:00pm.

Topics include Menu Engineering, Plate Costing, Food Service Accounting Management, Marketing, and more…

Maximize Your Restaurants Profits prior programs

maximize-your-restaurant-profits

This is a program of the Greater Chatham Initiative

More information: Foodlabchicago@GreaterChathamInitiative.org 773-644-1451

Once again thank you to our sponsors

June 16th Shopify for your restaurant presentation

AI for Restaurants: How to Use ChatGPT to Boost Profits, Enhance Guest Experience, and Streamline Operations

AI for Restaurants: How to Use ChatGPT to Boost Profits, Enhance Guest Experience, and Streamline Operations

3/6/25 & 4/10/25 presentations from the Illinois Restaurant Association and James Feldman AI expert

Replay of session I: Watch the Recording Here

Replay of session II: Watch the Recording Here

James Feldman: jfeldman@shifthappens.com

Digital Presence in action

We talk about “knowing your numbers” to make data-driven decisions.

We talk about “developing your team” so you can work “ON” your versus always “IN” your business.

Third, you hear us speak about the need for “digital presence” here is one example:

Way To Save This Struggling Restaurant, And It’s Proof That There Really Is A “Good Side” Of Social Media “I think I’ve seen around a thousand customers daily, which is crazy to think about considering we used to have about 5 to 10 customers a day.”

Read in BuzzFeed: https://apple.news/A-l67V5nSTFK1AgbVatgvww

Sources for economic support

The 2023 Source Grant - Cook County

Cook County $20,000 grants

Cook County $20,000 grants deadline August 25th

The Cook County Small Business Source proudly introduces The 2023 Source Grant, which will provide $40 Million in grants to small businesses to help stabilize operations, foster recovery and resiliency, and advance equity in a post-pandemic economy. $20,000 grants. All applications will be reviewed, it is not first come first served.

2023 Awardees: 2023-source-grant-awardee-list_a.o_02.02.24_final

Businesses located in Cook County with fewer than 20 full-time employees that were in business prior to 2020 are eligible to apply.

County website: HERE

State of Illinois OE3 Small Business and Infrastucture Grant Program 2025

OE3 $10 million in small business capital grants,

OE3 $10 million in small business capital grants,

application deadline April 7th, 5:00pm

up to 40 awardees $10,000 – $245,000 grants

GCI presented March 4th a grant info session for the State of Illinois OE3 and Neighborhood Opportunity Fund (NOF) grants

Zoom Session REPLAY Passcode: =aQvDf9t

NOF Grant: GCI March 4th NOF Presentation

OE3 State Grant GCI March 4th OE3 State Grant Presentation

Grant: $10,000 – $245,000 up to 40 awards ($10,000,000)

A cash request for a variable advance of 25% of the approved grant amount will be processed upon execution of the uniform grant agreement

Eligibility:

• Businesses owned by Socially Economically Disadvantaged Individuals (SEDI) with a maximum of 25 full-time permanent employees

• Very Small Businesses (VSBs), businesses with less than 10 employees

Businesses located in Community Development Financial Institution (CDFI) Investment Areas will be prioritized.

CDFI map HERE

• Must be registered in the Grant Accountability and Transparency Act (GATA) Grantee Portal

• Have a valid FEIN number (ITIN accepted in place of FEIN)

• Have a valid UEI number

• Have a current SAM.gov registration (this could take two weeks to get setup)

• Be in Good Standing with the Illinois Secretary of State

Program objectives:

• Business Growth and Expansion

• Property Acquisition

• Operational Efficiency and Modernization

• Energy Efficiency and Sustainability

• Compliance and Accessibility Improvements

• Workforce Development and Job Creation

• Long-Term Business Sustainability

Eligible Projects activities:

A bondable capital project includes expenditures that are generally aligned with the following purposes:

• Architectural Planning and Engineering Design: Costs related to planning, schematics, and detailed engineering for new construction or improvements.

• Site Selection and Land Acquisition: Expenses for identifying, evaluating, and acquiring land or buildings.

• Building Acquisition: Purchasing existing properties to support business operations or expansion.

• Demolition: Clearing land or structures in preparation for additional construction or improvements.

• Site Preparation and Improvements: Grading, paving, landscaping, or installing utilities to ready a site for construction.

• Utility Work: Installation, upgrades, or relocation of utilities to support the project.

• New Construction of Buildings and Structures: Costs associated with constructing new facilities or structures.

• Reconstruction or Improvement of Existing Buildings or Structures: Renovation, modernization, or expansion of current facilities to enhance functionality or extend useful life.

• Original Furnishings and Durable Equipment: Purchase of new equipment or fixtures essential for the facility’s operation. An exception within this category allows for the inclusion of durable movable equipment for rolling stock when it serves as the business’s point-of-sale operation. This exception also applies to original furnishings and durable equipment purchases that are essential to the operation of the rolling stock as point-of-sale operations.

• Asset Replacement: Replacing assets with higher-quality or more efficient alternatives.

• Expansion of Existing Buildings or Facilities: Increasing the size or capacity of current facilities to accommodate growth

Food trucks in lieu of bricks and mortar

Examples of allowable non-bondable projects:

1. Rolling Stock

• a commercial vehicle that can move, or be relocated easily, that serves as the point-of-sale

operation for the business.

• It often applies to vehicles used for specialized operations, like food service or personal services.

(i.e. food trucks, mobile barbers, etc.)

2. Durable Equipment

• equipment essential to the rolling stock point-of-sale operations.

2025-oe3-rolling-stock-eligibility-012825

Performance Goals and Measures

Job Creation/Retention

• Job Creation/Retention: Verify the number of jobs created or retained as a result of the project, based

on the job creation/retention plan provided.

• Salaries: Average of annualized salaries for permanent full-time jobs created and retained.

o Measurement: Compare actual employment numbers with the job creation/retention

projections provided in the application.

Impact on Business

• Financial Impact Post-Project: Evaluate the increase in revenue, profitability, or cost savings after the

project completion, as projected in the financial documentation submitted.

o Measurement: Review actual financial performance against the projections submitted in the

application (e.g., profit and loss statements, cash flow analyses).

Sustainability and Long-Term Viability

• Sustainability of Improvements: Assess the ongoing viability and sustainability of the project, as outlined

in the 24- to 36-month sustainability plan.

o Measurement: Track business performance and maintenance of project outcomes against the

sustainability plan and financial projections in the application.

Community Impact

• Local Economic Impact: Measure the project’s contribution to local economic development, particularly

in underserved areas.

o Measurement: Gather feedback from community stakeholders and compare with the

anticipated community impact as described in the application

Application Review Information – scoring oe3-application-review-information-012825

OE3 Grant Site

OE3 Grant Site

Webinar replays, application, help, FAQ’s below

Grant Notice with links

https://dceo.illinois.gov/aboutdceo/grantopportunities/2160-2940.html

Grant detail opportunity-pdf 14 pages or at bottom of page

https://omb.illinois.gov/public/gata/csfa/FileView.aspx?nofo=2940

Let’s Apply:

-

Area you in a qualified Area?: CDFI map HERE

• Have a valid FEIN number?

• Illinois Secretary of State’s website. Note, that your entity must be in Good Standing with the Secretary of State (Status – Active).

2. Do you have a current SAM.gov registration? (this could take two weeks to get setup)

SAM.Gov Create an account, sign-up 1-3 days to receive Unique Entity Identifier (UEI)

upper righthand corner “workspace” Create new entity.

Entity Validation, register your entity – set to “public”, a number of questions about your business. Be careful to be accurate SAM.gov matches your entries with the government databases. Core Business data to be inputted for registration Aftering clicking on “Submit” you will be notified by email (10-15days) You can also log back in and check your status.

1. Entity Identifier (UEI), a 12-character alphanumeric ID

2. SAM (CAGE code) (this is different from your UEI ID)

Federal Service Desk 866-606-8220 (long wait) FSD.gov portal knowledge base and live chat

Pre-qualification Info

https://dceo.illinois.gov/content/dam/soi/en/web/dceo/aboutdceo/grantopportunities/2160-2940/one-pager-prequalification-info.pdf

3. Register in the Grant Accountability and Transparency Act (GATA) Grantee Portal

Uniform Grant Application with supplement with details

https://dceo.illinois.gov/content/dam/soi/en/web/dceo/aboutdceo/grantopportunities/2160-2940/nofo-supplement-small-business-capital-and-infrastructure-grant-program-2160-2940.pdf

Application instructions

https://dceo.illinois.gov/content/dam/soi/en/web/dceo/aboutdceo/grantopportunities/2160-2940/application-instructions-small-business-capital-and-infrastructure-grant-program-2160-2940.pdf

Application smartsheet for uploading application

https://app.smartsheet.com/b/form/54ae15bd6e4d4c88a51b04d6167ea04e

DCEO Grantee video trainings and resources

www.Bit.ly/44DXILi (case sensitive) or HERE

GCI Application Cheat Sheet with links to required documents

oe3-smartsheet-and-certificate-links-040225

FAQ’s HERE

Webinars:

January 14 Grant introductorywebinar replay

Technical Assistance webinar focused on the application

February 4th Replay HERE

Grant Help Desk Illinois Department of Commerce & Economic Opportunity Email: CEO.GrantHelp@illinois.gov

Program manager ceo.OE3Grant@illinios.gov

Hello Alice Small Business Grants

Progressive Casualty Insurance $50,000 commercial vehicle grants

Deadline June 14, 2024 at 6:00PM ET.

Progressive is dedicating $1 million to award 20 deserving businesses with $50,000 grants each to purchase a needed commercial vehicle.

And that’s not all – recipients will also get access to an exclusive 12-week virtual Boost Camp coaching program, designed to equip business owners with the tools & resources to help them achieve their growth objectives.

- Be a for-profit business located and registered in one of the fifty United States or the District of Columbia; excluding US Territories;

- Have 10 or fewer employees and less than $5M in annual gross revenue;

- Have demonstrated need for a qualifying commercial vehicle and have a clear plan for growth as as result of this vehicle purchase;

- Businesses may not be an independent contractor whose primary business is for a rideshare service such as Uber or Lyft, or third-party food delivery such as UberEats, DoorDash, PostMates, Grubhub, Instacart, etc.

- go to https://helloalice.com/grants/progressive; (2) create an account or log in if you already have an account; and, (3) complete and submit application (“Entry”). The full list of Entry questions can be found in the application form at https://app.helloalice.com/grants/progressive-driving-small-business-forward-2024.

Application https://helloalice.com/grants/progressive

- Entries will be reviewed by Sponsor, Progressive Casualty Insurance Company and/or their designated agencies (“Panel”) based on the following criteria:

- Demonstrated need for funds to purchase a commercial vehicle (40%)

- Clear plan for growth as a result of a vehicle purchase (40%)

- Demonstrated commitment to customers and community (20%)

Hello Alice Grants HERE

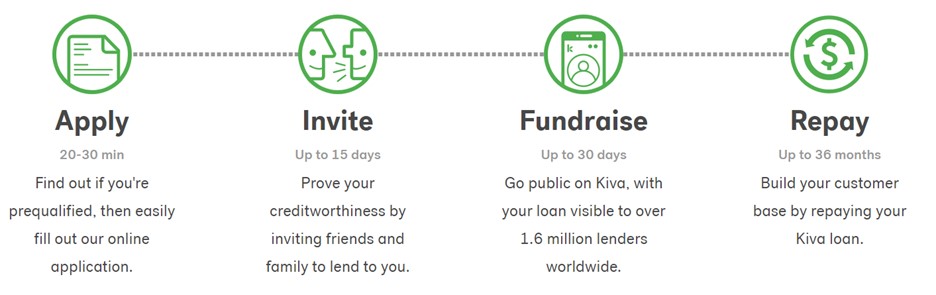

KIVA Micro-loan program

Kiva is a 501(c)3 U.S. nonprofit fueled by passionate people. Founded in 2005, and based in San Francisco, with offices in Bangkok, Nairobi, Portland and staff around the globe.

4.4 million borrowers, 77 countries, 2.1 million lenders, funded $1.8 billion in loans, 96.4% repayment rate

Loans from $1,000 – $15,000 0% interest, no fees,paid back over 36 months

Administered by our friends at the Women’s Business Development Center matching lending from LISC Chicago

KIVA borrowing more details

- Apply to KIVA through the WBDC

- $1,000 – $15,000 as determined by KIVA

- Invite friends and family to join in your campaign with a $25 loan (will be repaid)

- Then your project is opened to KIVA’s 1.6 million participants, and you have 30 days for them to sign up with their $25+ participation. LISC will match $ for $ each KIVA participant/lender

0% interest, 0% fees, paid back to all lenders/participants over 36 months.

For more information, reach out to:

John Handler jhandler@GreaterChathamInitiative.org

LISC Kevin Hart and The Coramino Fund $10,000 Grants

Kevin Hart and Gran Coramino tequila (The Coramino Fund) to provide $10,000 grants to 50 Black and Latin-owned businesses around the country priority to firms in distressed areas. Deadline for application 11:59 pm PST Wednesday April 23rd

Application is pretty quick and easy. Two discussion questions (below), no documentation is required at this time.

#30 General comments or any other information about you and/or your business that you would like to share with us. 1,000 characters

#31 Please describe any ways you have connected with your local community through your business. 1,000 characters

Let them know you are a South Side Chicago business in an disinvested area…….. FAQs are below

The program provides $10,000 grants to Black and Latinx entrepreneurs. The grants are designed to foster business growth, with flexible uses including but not limited to:

- Hiring new staff or promoting existing staff to bring a new product or service to market;

- Purchasing equipment to add a new product or service to the business offerings;

- Upgrading physical space to better serve customers; and

- Launching a marketing and promotional campaign to attract more customers

Small businesses that receive grants will be offered AI education through 1st Street Partnerships, a new partner of Gran Coramino® Tequila. The adoption of this technology enables businesses to streamline operations, enhance customer experiences, and make data-driven decisions. This training will help small businesses compete with larger firms that leverage AI for efficiency and innovation.

If selected as a finalist back-up proof will be requested.

LISC Website HERE

The Coramino Fund HERE

Application HERE

FAQs HERE

LISC Uber Black Restaurant Fund

LISC and Uber team up for the Black Restaurant Fund $50,000 – $250,000 growth capital loans to help fuel 35 businesses over the next three years

The Growth Capital Program seeks to provide access to flexible, growth-oriented capital to entrepreneurs. These investment dollars are not intended to be used as working capital and are not a replacement for debt financing. Instead, these investments are intended to fully fund a well thought out business expansion/growth plan. Investee businesses will repay LISC if/when their expansion plan succeeds. Please see a full description of the investment terms and structure here.

This initiative is an unsecured financing program focusing on Black-owned restaurants or food service businesses. The funds enable business owners to cover costs related to business growth and expansion plans or necessary technology, infrastructure, insurance, or certification expenditures that will help stabilize the business and create opportunity for additional revenue streams. $50,000 – $250,000

Growth capital is a patient, low cost, revenue-based financing product designed to allow business owners the time they need to invest in and stabilize their business before repayment begins. Unlike a traditional loan product, growth capital does not have fixed repayment terms. Instead, business owners begin repaying a percentage of their revenue each quarter, once their business plan proves successful.

Who is eligible for the program?

This program is open to restaurants and food services businesses nationally. Additionally, focus will be given to businesses with:

- Annual revenues above $250,000 and below $3,000,000

- Black-owned businesses

- 2 years or more in business

- Restaurants registered on Uber Eats

- Sole proprietors and nonprofit organizations are not eligible for the program

How is this financing structured?

LISC will fully fund a growth or expansion plan, up to $250,000. The business will have a minimum of one year before repayment begins. After one year, the investment will start to repay one quarter after the business hits pre-agreed revenue targets. The business will pay a share of its revenue, as long as revenues are greater than revenues at time LISC provides funding plus the LISC investment amount. The revenue share split will be based on a three-year par recovery of the investment. However, the business will make payments to LISC through the earlier to occur of (x) full repayment to LISC of its revenue share or (y) five years from LISC’s investment. After the end of the investment term, the business will not be required to make further payments to LISC. The revenue share will be capped at a multiple of 1.5X LISC’s original investment. $100,000 investment pay back $150,000 over three years, up to five years.

Documents required:

Businesses seeking growth capital will need to be prepared to submit at minimum:

- Business/growth plan that outlines plans for expansion and job creation

- Business and Owner Tax Returns

- Interim Business and Owner Financial Statements (P&L and Balance Sheet)

- Business Debt Schedule

- Articles of Incorporation (Corporation) or Organization (LLC)

- Certificate of Good Standing

Application questions to be answered:

+ Please specify the primary purpose of these investment dollars. Include a detailed description or your current business plan and a description of how you would use this investment to expand your business/operations

+ How much money would you like to request from this program in order to execute your business expansion plan? (requests must be for amounts between $50,000 and $250,000)

+ Please explain exactly what you would spend the above requested dollars on.

+ Please describe the competitive landscape where you are operating. This will include a description of other businesses that you currently compete with as well as businesses you may be newly competing with given your expansion plan. This should also include an explanation of why you believe you will be successful, given this landscape.

+ How many jobs do you believe you will add as a result of this business expansion plan?

+ General comments or any other information about you and/or your business that you would like to share with us.

For more information on the Black Restaurant Fund https://www.liscstrategicinvestments.org/uber-black-restaurant-fund

LISC monitors inquiries sent to SIGrowthCapital@lisc.org

Grow with Google Digital Coaches

Now Available: Virtual Workshops for Small Business Owners and Entrepreneurs

Main Street America and Grow with Google have teamed up to help business owners gain new skills through local Digital Coaches. Through the Grow with Google Digital Coaches program, 10 coaches in small towns across America are offering live trainings and hands-on coaching on tops like how to connect with customers, sell more products online, and improve business productivity – all for free.

Starting in September and continuing through November, Grow with Google Digital Coaches will host a series of both live and on-demand virtual workshops for small business owners. These workshops are free and open to all small business owners and entrepreneurs across the network, beyond the 10 states hosting in-person trainings.

Learn more about each workshop and find registration details HERE

Verizon / LISC Small Business Digital Ready

![]() Verizon / LISC Small Business Digital Ready Online Curriculum

Verizon / LISC Small Business Digital Ready Online Curriculum

and $10,000 grant opportunity December 13th deadline for grants expired, expect next round inthe spring

Online curriculum is designed to give small businesses tools to succeed in today’s digital world. Learning modules can help your business thrive with topics such as SEO, working remotely, and finance management. Learning modules, expert coaching, peer networking, and more. Pretty good content, worth your time investment,

Register for a free online curriculum. Complete any combination of two courses, coaching events, and virtual community events to unlock the application for a $10,000 grant in partnership with LISC. Grant applications must be submitted by June 28th, 2024 to be considered. Not all applicants will receive funding.

Application is quick. Two discussion questions

- General comments or any other information about you and/or your business that you would like to share with us, including how this would help you grow your business. (1,000 characters)

- Please describe any ways you have connected with your local community through your business (1,000 characters)

More program details HERE

Program sign-up HERE

Need help registering?

Email digitalready@verizon.com or call +1(800)-916-4351

New Reforms for SBA’s Community Advantage Loan Program

On March 30, 2022, Vice President Kamala Harris and Administrator Isabella Casillas Guzman announced impactful reforms to the agency’s Community Advantage loan program, a key SBA tool for Community Development Financial Institutions, Community Development Companies, microlenders and other critical mission-based lending partners, that prioritizes equitable access to capital for low-income borrowers and those from underserved communities. 7 (a) program

The Illinois Restaurant Association Employee Relief Fund(IRAEF)

The Illinois Restaurant Association Employee Relief Fund(IRAEF) will offer emergency assistance grants to Illinois food and beverage workers facing an life-altering, unanticipated hardship within the past 90 days such as: accident, illness, injury, death of an immediate family member or natural disaster. All grant requests will be reviewed. The grants cover costs of living expenses for life-altering events and range from $250-$1500.

Proof of hardship :

- Rent or mortgage bill or statement

- Bills; electric, gas, water/sewer, homeowners association or property tax statements

- Documentation of illness or injury

- Receipts for medical supplies or transportation for medical care

- Verification documentation for funeral expenses, natural disaster, or housing emergency

- Doctor verification or death certificate

Steps

- Fill out the application in its entirety

- Be prepared with your documents to upload that align with the reason why you are applying for this IRAEF Restaurant Employee Relief Fund grant:

- Document One: Proof of Illinois residency (Valid Illinois License or State ID)

- Document Two: Pay Stub from the current foodservice establishment where you are employed for a minimum of 90 days

- Document Three: Proof of hardship

- Document Four: Additional documentation if applicable (not required)

- All applications that meet our established criteria will be evaluated

- Depending on funding, eligible applicants will be given a grant and notified via email and when to expect the grant check via mail

- Once received, the check is yours to spend in the impact area highlighted within your application. You are not taxed on this grant, nor will you owe it back.

IRAEF is dedicated to managing all the requests for financial support, and it is our goal to help as many in the restaurant community as possible. All qualified grant requests will be reviewed. Restaurant Employee Relief grants are awarded to eligible individuals based on available funds and limited to one per individual.

It is our goal to support as many in our restaurant community as possible. All qualified grant requests will be reviewed. Restaurant Employee Relief grants are awarded to eligible individuals based on available funds and limited to one per individual.

The applications for the IRAEF Restaurant Employee Relief Fund are currently open and the grants are awarded on a rolling basis. Apply Here

TIF corridors of interest, Lottery results

SBIF Program – Somercor website

GCI Info Sessions: Hope everyone enjoyed the information presented on NOF, CDG and SBIF grant opportunities on Oct 21st, Monday (in-person) and Oct 22nd, Tuesday (webinar).

PowerPoint presentation: grant-info-session-presentation-october-2024-jsh-1.0-

and you can watch the replay of the webinar through this link HERE (speaking starts 3 min mark)

SBIF Flyer sbif-flyer-v4

The City of Chicago’s Small Business Improvement Fund (SBIF) promotes economic development by providing small businesses with reimbursable grants for permanent building improvement costs. SBIF grants use local Tax Increment Financing (TIF) revenue to reimburse you for the pre-approved repair or rehab of your business facilities or adjacent land acquisition.

SBIF grants are available for commercial and industrial businesses and property owners. No residential. SBIF provides grants up to $150,000 to commercial businesses for 90% of the costs of permanent building improvements such as storefront renovations, building systems, interior remodeling, roof replacement.

SBIF District Finder: HERE

January 2022 SBIF Program Rules 2022 SBIF Program Rules

More info and application HERE

Sign up on the Somercor website to get notices of SBIF District openings.

Community Development Grants, previously Chicago Recovery Plan Grants

City of Chicago Community Development Grants

City of Chicago Community Development Grants

New classifications:

Small Grants (<$250,000)

Medium Grants ($300,000 – $5,000,000)

Large Grants (>$5,000,000)

CDG Small Grants accepting applications until 11:59pm August 15th, 2025

Medium Grants is currently accepting applications until 11:59pm August 15th, 2025.

Large grants – accepted on a rolling bases

Again this is a grant (not a loan) funding to support local commercial, mixed-use, and light manufacturing development. City staff will prioritize projects in areas of Chicago where there is a history of disinvestment or limited private investment. Project selections are based on business readiness, viability, location, design, neighborhood needs, community impact, and other factors. The City of Chicago Department of Planning and Development (DPD)

The 2023 small grant application has evolved sample PDF of questions 2023 Small Grant Application Questions

GCI Info Sessions: Hope everyone enjoyed the information presented on NOF, CDG and SBIF grant opportunities on Oct 21st, Monday (in-person) and Oct 22nd, Tuesday (webinar).

PowerPoint presentation: grant-info-session-presentation-october-2024-jsh-1.0-

and you can watch the replay of the webinar through this link HERE (speaking starts 3 min mark)

Small

Next deadline for CDG-Small applications is August 15th by 11:59pm

CDG-Small grants are provided as a reimbursement for up to 75% of the total eligible project expenses with a maximum grant of $250,000. Potential applicants are encouraged to attend an information session.

Resources are available to assist with applications, view webinars in English or Spanish:

- Webinar: Tuesday, August 20th | 2:00 pm View Recording

- Webinar: Monday, September 9th | 2:00 pm Presented in Spanish/Presentado en Español View recording

- Webinar: Monday, October 28th | 2:00 pm View Recording

Visit the Small grant resources page, or view the Small grant FAQs for more information.

Medium

Visit the Medium grant FAQ or view the information session presentation for both Medium and Large grants.

Register for free on Submittable to review and complete applications.

Large

Visit the Large grant FAQ or view an application webinar for both Medium and Large grants.

Register for free on Submittable to review and complete applications.

Eligibility

- Applicants from all areas of Chicago are eligible to apply. Priority projects are located in historically disinvested areas and/or build upon existing efforts and community safety initiatives.

- Priority is given to catalytic projects with a strong local impact that are able to leverage local talents, capacities and institutions to strengthen and contribute to the community.

- Priority is given to projects that demonstrate momentum and are expected to break ground within six months of grant acceptance.

Deadline: below

Apply here: https://www.chicago.gov/city/en/sites/dpd-recovery-plan/home/Community-Development-Grants.html

For additional resources you can visit the Community Development Grant Resources or read the Chicago Recovery Grant FAQs.

View the webinar for grants more than $250,000.

Download the Large Grant Application Overview.

City of Chicago :: $25 Million in Business Development Grants Announced by Mayor Johnson

List of 2023 Winter Finalists

2022 was a good year for City grants, with $122.5 million to 166 finalists!

May 2nd, 26 grant finalists ($33.5 million) from Jan 31st round: Spring CRP 26 Finalists

July 18th, 79 grant finalists ($49 million) from March 10th round: Summer CRP 79 Finalist

November 30, 61 grant finalists ($40 million) from August 19th round: Fall CRP 61 Finalists

Nov 30 Mayor’s Press Release: 2022.11.30-mayors-press-release-grant-neighborhood-businesses

GCI Area Finalist GCI Area Grant Finalist

More info: John Handler JHandler@GreaterChathamInitiative.org (773) 644.1451

Eligibility

- Grant funding can be used for pre-development, construction, or renovation costs for permanent capital improvement projects.

- CRP will pay for the acquisition of the property costs, but only up to an amount equal to the construction costs. For example, if the property’s purchase price is $100,000. If renovations are $25,000, CRP would provide another $25,000 toward the property’s purchase.

- Open to community developers, business owners and entrepreneurs, and property owners. Site control is preferred, but not required.

- Residential-only development is not eligible, but mixed-use projects are eligible. Further funding opportunities for residential projects are expected to be announced in Q1 2022.

- Priority will be given to catalytic projects with a strong local impact, that are able to leverage local talents, capacities, and institutions to strengthen and contribute to the community.

- Applicants from all areas of Chicago are eligible to apply. Priority will be given for projects in historically disinvested areas as well as projects that build upon existing efforts, such as Mayor Lightfoot’s INVEST South/West initiative and community safety initiatives.

- Priority will be given to projects that demonstrate momentum and are expected to break ground in 2022.

- The City expects awards to be capped at $5 million, though larger, catalytic projects may be considered.

DPD Community Development Grants (CDG)

DPD Community Development Grants website

CDG or NOF? If you are in a NOF corridor select NOF NOF Corrridor HERE otherwise check CDG. More on te difference below.

Prepare to Apply

Applications will be segmented based on the size of the grant. Grant requests should represent no more than 75 percent of the anticipated total project cost. For example, at 75% reimbursement, a $250,000 would support a $333,333 project cost.

SMALL GRANTS: Grant application for less than $250,000 (Small) HERE

Have to submit your grant request online (above links),

MEDIUM GRANTS: Grants larger than $250,000 up to $5 million

NEW: The large grant application must now be submitted online

Large Grant Online Application HERE

- Site Control

- Photos

- Describe proposed project

- Project purpose

- Financial need

- Developer Input form required and upload

- Sources of funds

- Design & construction documentation

- City of Chicago construction compliance

Universal Financial Request Application (has to be submitted online below are samples of the online application for your review)

2022-August Word Doc of Large GRant Application Must be completed online

2022-August Large Application Word Doc of essay questions and important uploads

Developer input form – not macro enabled (down load ZIP file for active input form)

FID Developer Input form not macro enabled

Zip file download of old universal application and Developer Input Form HERE

Helpful Grant Resources and Explanations HERE

Project Readiness / Financial Feasibility / Construction Planning / Catalytic Impact / Business Planning

Strong applications have:

Very competitive, one in ten chance of being selected

1) Site control

Own the property, letter of intent to purchase, lease of at least 3 years

2) Project

Clear description, drawings, pictures

Detailed project budget with contractor bids

Financing for your 25%

Project and construction timeline

3) Business Plan

How you are going to make money?

How big is the market?

Competition?

Your’s and the team’s resumes, that you have done this before

4) Community

Is your project catalytic?

Activating a disinvested area

How many new jobs, training opportunities?

Bring new customers into the area?

Aligned with the community plans and development?

5) Design and Visual appeal

Equity & Inclusion: Achieving fair treatment, targeted support, and prosperity for all citizens

Innovation: Implementing creative approaches to design and problem solving

Sense of Place: Celebrating and strengthening the culture of our communities

Sustainability: Committing to environmental, cultural, and financial longevity

Communication: Fostering design appreciation and responding to community needs

Chicago Recovery Plan Community Development Grant Information Session

An informational webinar was held Wednesday, Jan. 6 2022. Watch a recording of the webinar here,

City’s January 6th, 2022 Powerpoint Presentation: download the presentation

For advice and potential resources to help with your application, please go to the Community Development Grant Resources page.

For any additional questions, please email dpd@cityofchicago.org

Comparison NOF to CRP

Neighborhood Opportunity Fund Grants (NOF)

Small <$250,000 Large <$2.5 million

Reimbursements 50% project, 25% wealth bonus, 25% hire local (potentially 100%)

Acquisition 50% Small, 30% Large

Specific corridors – In Invest South/West, priority zones

Commercial properties only

Chicago Recovery Plan Community Development Grants (CRP)

Small <$250,000 Large <$5 million

Reimbursements 75% project

Acquisition 75% Small, 75% Large

Specific corridors – Chicago city limits

Commercial with some residential, light manufacturing

Vanilla box buildout without an identified tenant

Neighborhood Opportunity Fund (NOF)

GCI presented March 4th, 2025 a grant info session for the State of Illinois OE3 and Neighborhood Opportunity Fund (NOF) grants

Zoom Session REPLAY Passcode: =aQvDf9t

NOF Grant: GCI March 4th NOF Presentation

OE3 State Grant GCI March 4th OE3 State Grant Presentation

GCI Info Sessions: Hope everyone enjoyed the information presented on NOF, CDG and SBIF grant opportunities on Oct 21st, 2024 Monday (in-person) and Oct 22nd, Tuesday (webinar).

PowerPoint presentation: grant-info-session-presentation-october-2024-jsh-1.0-

and you can watch the replay of the webinar through this link HERE (speaking starts 3 min mark)

NOF Small Grants are open, next cutoff August 15th, 11:59pm (followed by Nov 14th)

Large Grants (not Small <$250,000) is currently open under the CDG Medium banner just closed Feb 14th.

Neighborhood Opportunity Fund are grants (not loans) that help strengthen commercial corridors in Chicago’s South, Southwest and West Sides. The NOF finances commercial and cultural projects in neighborhoods that lack private investment, using revenue generated from downtown development.

Projects like:

- Storefront buildout

- Facade repair, window door replacement

- Plumbing, electrical, and HVAC work

- New Construction

- Property acquistion

- Roofing repair

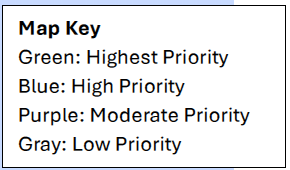

See if your project is in a NOF Corridor HERE

Neighborhood Fund (NOF) Guidelines and information HERE

NOF FAQs HERE

Please see the NOF’s official DPD page or contact NOF@cityofchicago.org.

Somercor’s NOF website HERE

Project eligibility:

NOF does not award grants for the construction or rehabilitation of residential uses, manufacturing uses, industrial uses, social services (including daycare and elder care), or places of worship that do not identify commercial as the primary use of a project. Non-profit organizations are eligible for the NOF grant, but they must be engaged in a retail or commercial activity or providing a cultural asset that is open to the public.

Grant Types – How much funding can you get?

NOF offers two types of grants: Small Projects (assistance of $250,000 or less), and Large Projects (assistance of $250,001 – $2.5M). The NOF assistance available to your project depends on the project location and the amount of financial assistance being requested.

Small Projects (grants up to $250,000)

NOF Small Projects must be located in an Eligible Commercial Corridor, which are public streets that are generally zoned for retail or commercial uses. Projects are required in these locations so that they can be concentrated to create a larger, collective impact. Projects may also be located within a Priority Investment Corridor, which is similar to an Eligible Commercial Corridor, but has a greater amount of retail or commercial activity. Although not required, projects located within Primary Investment Corridors, will receive extra weight during the application review process.

Please refer to the Project Eligibility map below to determine if your project is eligible for the grant.

Large Projects (grants exceeding $250,000, up to $2.5M)

NOF Large Projects do not have to be located in an Eligible Commercial Corridor, but must be located within the Qualified Investment Area (QIA). Large Projects must receive City Council approval and a Redevelopment Agreement that governs the terms of the grant. Large Projects are subject to the City’s construction compliance requirements, which include MBE/WBE, Local Hiring and Prevailing Wage (as established by the Illinois Department of Labor). We encourage applicants to contact us with questions about NOF Large Projects in advance of submitting an application.

Projects located within an Eligible Commercial Corridor are eligible for both the Small and Large Project grants; however, projects that are located outside of an Eligible Commercial Corridor and requesting more than $250,000 are only eligible for Large Project grants.

Applications are prioritized based on the following four key factors:

- Catalytic impact. Applicants should submit projects that provide services or goods currently lacking in an area, and specify how their projects will build stronger communities or commercial corridors.

- Project readiness. Applicants should have site control of the project property, or be engaged in the process of obtaining site control. Selected properties should not have significant issues, such as mechanic liens, court orders or past due property taxes.

- Project financial feasibility. Applicants should clearly identify the uses of grant funds and the sources of, or the strategy to obtain, their portion of funding.

- Construction implementation. Applicants should demonstrate a clear and ready path to implementation.

The City’s Department of Planning and Development reviews all applications and submits them to an Advisory Committee, which is comprised of community leaders who represent a cross-section of neighborhoods. The committee reviews DPD’s recommendations for final selection and provides approval or feedback.

Allies for Community Business - Good Food Fund Grants

Round 2 application window closes 11:59pm Friday, September 13th

The second round of the Good Food Fund Grant is currently open for applications and closes Sept 13th. This is not first come, first served, so invest time to complete a strong application. GCI is available to assist with your application.

The Good Food Fund aims to support small food businesses and food entrepreneurs in communities with inequitable food access.

August 13 City Press Release: Mayor Brandon Johnson and Chicago Department of Business Affairs and Consumer Protection Announce The Good Food Fund Grant Awardees

Round 1 Awardees List 2024-good-food-fund-round-1-awardees-081324

Good Food Fund Grants $10,000- $100,000

The Good Food Fund will provide support for Chicago food entrepreneurs in communities with inequitable access to food. The Good Food Fund was designed after intensive community engagement with the Food Equity Council and seeks to help expand, enhance, and restore the food industry using an equity and community-based approach.

This is very competitive, think about how you will utilize the grant, more than just paying bills. How it will benefit your business and the community.

Again it is not first come, first serve, so you have some time to put together a strong application.

ROUND 2 versus ROUND 1

If you applied for round 1 you can apply for round 2. Application has changed you’ll have to fill out a new application

Only one application form to complete (the expression of interest has been eliminated)

Both for-profit and non-profit organizations are eligible

Grant amounts will be assigned automatically based on 2023 gross income (see below).

The minimum 2023 revenue threshold is $10,000.

One 50 word narrative describing how you plan to use the grant funds. Was four narratives.

Like in Round 1 grant funds can be used for most anything

Eligibility

Currently operating food or non-alcoholic beverage business focused on agriculture, manufacturing, processing, wholesale, distribution, service, retail, or research and development. (See the application questions for a list of eligible industry codes.) Business is located in the City of Chicago, filed 2023 Federal tax return showing a minimum $10,000 gross receivables (not profit/ net income) Hold a current business license, business bank account More below

Grant awards will be calculated based on 2023 gross revenue:

- $10,000 for businesses with $10,000 – $100,000 gross revenue or fiscal sponsor applying on behalf of a new business

- $30,000 for businesses with $100,001 – $250,000 gross revenue

- $100,000 for businesses with $250,001or more gross revenue (limited to a maximum of five grants)

Priorities for Funding

- Located in an area of Chicago with low food access.

- Locally owned and operated.

- Serves local customers.

Application Information

GCI Good Food Fund Grant informational webinar Thursday, August 29th

Presentation Powerpoint: 2024-round-2-good-food-fund-gci-informational-webinar-final-082924

Entrepreneurs seeking free grant application assistance can contact GCI Jhandler@GreaterChahtamInitiative.org

Also A4CB by calling 872-710-0035 or by sending an email to help@a4cb.org.

Allies for Community Business informational grant August 14th webinar replay Allies’ Zoom Replay : LINK HERE

More Allies Grant information visit: a4cb.org/grants

Review the application questions Here before applying:

Frequently asked questions, click Here

Allies’ Grants website and online application: Grants • Allies for Community Business (a4cb.org)

Important Note: Be prepared to answer all the application questions and to upload required documents before beginning. You will not be able to save partial applications and return to it later.

HERE IS WHAT YOU NEED TO KNOW

Eligible type: Businesses throughout the food and beverage supply chain are eligible. If you grow, supply, make, manufacture, sell, retail, or otherwise contribute to food and beverages.

The following business categories are not eligible:

o National Chains (Locally-owned franchises are acceptable)

o Liquor stores

o Cannabis related businesses

o This is a Food Equity Grant so bars, taverns, and night clubs are excluded

Eligibility criteria that you must meet:

- Food or beverage business (NAISC codes)

- Business address must be in Chicago.

- Hold a current food and beverage business license

- Has established a business bank account

- Filed a federal tax return in 2023 showing at least $10,000 of gross revenue.*

- Grant awards will be calculated based on 2023 gross revenue:

- $10,000 for businesses with $10,000 – $100,000 gross revenue or fiscal sponsor applying on behalf of a new business

- $30,000 for businesses with $100,001 – $250,000 gross revenue

- $100,000 for businesses with $250,001or more gross revenue (limited to a maximum of five grants)

*A fiscal sponsor may apply on behalf of a business in the incubation stage. See application instructions for details.

Selection Priorities

Businesses that have been served the community for a long time – how the grants can help grow the business and hire more staff

- Locally owned and operated

- Serves local customers

- Establishments in “Low Food Access” areas

Percent of residents who have low access to food, defined solely by distance:

further than 1/2 mile from the nearest supermarket in an urban area

Allies/BACP Map and community list

Chicago Health Atlas Detailed MAP

Usage of Funds:

How do you plan to use the grant funds? (50 words)

Prompts:

- Labor

Hiring additional employees, adding hours for existing employees, paying higher wages to existing employees, offering additional benefits, or improving working conditions

Pay a higher wage and look to providing benefits

Talent development, paid training hours and course work

Invest in teaching culinary skills, high school programs, etc

Invest in better recruiting and building a talent pipeline

Goal to increase retention, reduce turnover

- New construction, expansion, or capital improvements

Creating, improving, or expanding your physical business location

Improve aesthetics of front façade of building, safety glass versus bars on windows

Invest in better equipment to increase production and lower energy consumption

Reorganize cooking line for efficiency and safety

Invest in improve dining area

- Supplies

Items that will be consumed or used to produce your products

More bulk purchases to reduce costs

Better and larger refrigeration equipment to store larger quantities and product longevity

- Transportation / Distribution

Renting or paying the downpayment on a delivery vehicle, paying for transportation of your product, or other distribution costs

- Working Capital

Any expenses not included in another category.

Provide working capital to fund payroll and vendors. Marketing getting away from high-interest credit cards and vendor financing

APPLICATION Sections

https://app.smartsheet.com/b/form/e522c3bbaf3047c8bba88e51883b93b1

Application questions and FAQs are posted on line

Will not be able to save program – have to submit or lose it

Section 1 Business Basics

Be sure the business address you entered matches your documents – comment area

Fiscal sponsor

Sponsor Narrative

Describe the business you are sponsoring and how you are supporting their development. 400 words.

Who owns the new business?

How will the business increase or support food access in Chicago?

What has been completed so far to prepare this business for launch?

When do you expect the business to launch?

Business Classification

Primary food industry sector

NAISC code from your tax return

For corporations: You can locate your six-digit NAICS code on your federal tax return Form 1120, Page 4, Schedule K, Line 2a – Business activity code no.

For partnerships: You can locate your six-digit NAICS code on your federal tax return Form 1065, Page 1, Section C – Business Code Number

For sole proprietors/single member limited liability companies: You can locate your six-digit NAICS code on your federal tax return Form 1040, Schedule C, Section B – Enter code from

Instruction

For example:

- 7220 Food Services and Drinking Places

- 7223 Special Food Services – caterers

- 7225 Restaurants and Other Eating Places

Grant narrative (50 word max)

Comments above

Business Impact

Locally owned serving local customers

Business Owner Background

Attestations

Business is in good standing – cyberdrive lookup

Application documentation:

- Current Business License

2.Owner’s valid photo id

3. 2023 federal tax return

4. All pages of your most recent bank account from 2024

If applying to fund new construction, expansion, or capital improvement copy of deed or lease.

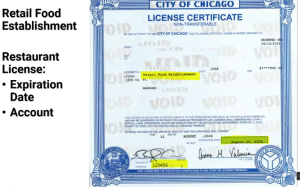

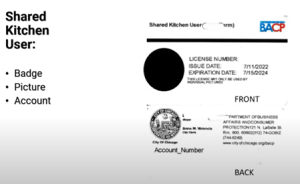

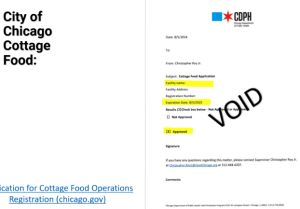

Current City of Chicago business license or cottage food operator certification

The expiration date must be after November 15, 2024 and the address must match the business

address entered above.

**If you do not have a license from the Chicago Department of Business Affairs and Consumer

Protection (BACP), please refer to the FAQ or contact help@a4cb.org or (872) 710-0035 for

assistance.

You will need to obtain a valid license by September 24, 2024 to receive a grant

BACP or Allies consultants can assist with Business licensing. Faster if apply in person

- Business owner’s valid form of photo identification

All pages of your most recent business bank account statement from 2024

Must show the bank name and address, business name and address, and the account number.

- All pages of your business’s 2023 federal tax return

Valid forms: Form 1040 with Schedule C, Form 1065, Form 1120, or Form 1099

Include all pages of the tax return and a signed e-file authorization from your accountant or

confirmation from the IRS that your return was accepted.

- All pages of your most recent business bank account statement from 2024

Must show the bank name and address, business name and address, and the account number.

- Property lease or deed

Required if the business address entered above does not match the address on the tax return.

The expiration date must be after November 15, 2024, must list the business name and/or

owner name as the lessee/renter, and must be signed.

Document Comments

Optional.

Provide any details needed to review your documents. For example: if we need a password to open

your tax return, or if the address on a required document does not match the address you entered

on your application, explain that here. If not needed, please leave blank

Allies for Community Business - Loans, Credit lines, and Coaching

Good Food Fund Loan

|

The Good Food Fund Loan is a low-interest term loan or line of credit between $500 and $100,000 available to eligible food and beverage entrepreneurs in Chicago! Made possible through Mayor Brandon Johnson and the City of Chicago’s Department of Business Affairs and Consumer Protection’s Good Food Fund, entrepreneurs will pay 3% in interest and 2% in closing fees over a term between one and three years depending on the loan size. To be eligible for the loan, the business must be in the food and beverage industry and must operate in Chicago. Want to connect with us before applying? Click here to schedule a session with a Community Lender or contact us at 312-929-1952 or loan@a4cb.org. |

Apply HERE a4cb.loanwell.com

Loan FAQs HERE Loans • Allies for Community Business (a4cb.org) (go down the page)

Chicago Good Food Fund bit.ly/chicagogoodfoodfund.

Chicago food and beverage entrepreneurs! Could you use free one-on-one business coaching to help tackle your current business challenges and opportunities? Our Business Coaching team is here to help! Made possible by Mayor Brandon Johnson and the City of Chicago’s Department of Business Affairs and Consumer Protection, A4CB is now offering enhanced coaching for Chicago’s food and beverage entrepreneurs.

Schedule a Session

Get the capital you need to heat up your business this summer! We offer term loans and lines of credit between $500 and $100,000 to early, emerging, and established businesses in Illinois and Indiana. Our interest rate is fixed at 9%, only slightly above today’s current prime rate.

Complete your application today in 10 minutes or less, or click here to schedule a session with a Community Lender before applying.

Start your application HERE

More loan information and FAQs HERE

Accion Loan Fund

Chicago Food Enterprise Loans (C-FEL) for Food Entrepreneurs of Color

Target Food Business Segments

1. Food Service Providers – i.e., caterers and food trucks

2. Commercial Kitchens

3. Grocery Stores – including Ethnic Grocery Stores, Health Food Stores, corner grocers

4. Restaurants – including Full Service and Limited Service, Juice Bars

5. Food Innovation – including technology products for healthy food retail.

Loans for working capital, inventory, equipment, and leasehold improvements.

- Loan amounts from $15K – $250K

- No or Low equity and collateral requirements

- Interest rates starting at 5.5% fixed

- Most loans include 12-month interest-only period, and terms up to 11 years

Loans for real estate acquisition and renovation

- Loan amounts from $100K to $1M+

- Up to 90-100% loan to value (LTV)

- competitive interest rates

How to qualify

- Be an existing business or nonprofit with at least two years of tax returns

- Be located in Chicago Metropolitan Area

- Serve the Black or Latino community

- Be a food system entrepreneur operating in a low- or moderate-income community

- Be currently open and operating

- Have no outstanding judgments or tax liens

- Have no bankruptcies in the last three years

Funding subject to availability

C-FEL Flyer C-FEL Flyer

Chicago Food Enterprise Loans (C-FEL) for Food Entrepreneurs of Color

Target Food Business Segments

1. Food Service Providers – i.e., caterers and food trucks

2. Commercial Kitchens

3. Grocery Stores – including Ethnic Grocery Stores, Health Food Stores, corner grocers

4. Restaurants – including Full Service and Limited Service, Juice Bars

5. Food Innovation – including technology products for healthy food retail.

Loans for working capital, inventory, equipment, and leasehold improvements.

- Loan amounts from $15K – $250K

- No or Low equity and collateral requirements

- Interest rates starting at 5.5% fixed

- Most loans include 12-month interest-only period, and terms up to 11 years

Loans for real estate acquisition and renovation

- Loan amounts from $100K to $1M+

- Up to 90-100% loan to value (LTV)

- competitive interest rates

How to qualify

- Be an existing business or nonprofit with at least two years of tax returns

- Be located in Chicago Metropolitan Area

- Serve the Black or Latino community

- Be a food system entrepreneur operating in a low- or moderate-income community

- Be currently open and operating

- Have no outstanding judgments or tax liens

- Have no bankruptcies in the last three years

Funding subject to availability

C-FEL Flyer C-FEL Flyer

Chicago Food Enterprise Loans (C-FEL) for Food Entrepreneurs of Color

Target Food Business Segments

1. Food Service Providers – i.e., caterers and food trucks

2. Commercial Kitchens

3. Grocery Stores – including Ethnic Grocery Stores, Health Food Stores, corner grocers

4. Restaurants – including Full Service and Limited Service, Juice Bars

5. Food Innovation – including technology products for healthy food retail.

Loans for working capital, inventory, equipment, and leasehold improvements.

- Loan amounts from $15K – $250K

- No or Low equity and collateral requirements

- Interest rates starting at 5.5% fixed

- Most loans include 12-month interest-only period, and terms up to 11 years

Loans for real estate acquisition and renovation

- Loan amounts from $100K to $1M+

- Up to 90-100% loan to value (LTV)

- competitive interest rates

How to qualify

- Be an existing business or nonprofit with at least two years of tax returns

- Be located in Chicago Metropolitan Area

- Serve the Black or Latino community

- Be a food system entrepreneur operating in a low- or moderate-income community

- Be currently open and operating

- Have no outstanding judgments or tax liens

- Have no bankruptcies in the last three years

Funding subject to availability

C-FEL Flyer C-FEL Flyer

Pivot Loan Program

For non-food related businesses please consider the Pivot Loan program.

Funding subject to availability

For more information and other financial products:

Cynthia Valle Cvalle@self-help.org

Seaway building on 87th

Commercial Team commericalloans@self-help.org

Self-Help CU website

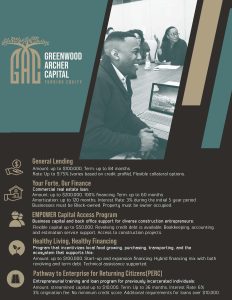

Greenwood Archer Capital (GAC)

Greenwood Archer CapitalTM

1000 E. 111th St, 10th Floor, Chicago IL 60628

www.greenwoodarchercapital.org

Greenwood Archer Capital is a CDFI (Community Development Financial Institution). Different from conventional banks and credit unions, CDFIs are part of a US Department of the Treasury program aimed at distressed communities so are able to accept more lenient credit profiles, lower down payments, collateral options, and more favorable interest rates. In addition, Greenwood Archer is a member of the State of Illinois Advantage/FAME program where the state will join with GAC to provide borrowers very favorable interest rates. GAC also has SBA products.

General Lending

Amount up to $100,000 (State of Illinois participation)

Rate varies per credit profile. Flexible collateral options

Your Forte, Our Finance (Matt Forte, Chicago Bears)

Commercial Real Estate Loan

Up to $200,000, 100% financed

Business must be Black-owned and owner-occupied

Empower Capital Access Program

Business capital and back office support for diverse construction entrepreneurs

Flexible capital up to $50,000 Revolving credit debit is available.

Healthy Living, Healthy Financing

For local food growing, purchasing, transporting and the ecosystem that supports this.

Up to $100,000 start-up and expansion financing. Technical assistance is available.

Pathway to Enterprise for returning Citizens (PERC)

Entrepreneurial training and loan program for previously incarcerated individuals.

Streamlined capital up to $10,000. Additional requirements for loans over $10,000

GAC Product Flyer

Apply for a loan HERE

Contact:

GAC Website: HERE

State of Illinois DCEO

Programs:

Advancing the Development of Minority Entrepreneurship (ADME)

ADME is a community investment program developed to strengthen Illinois’ start-up and small business community ecosystem by tapping into the potential of minority business owners and entrepreneurs. ADME supports the Department’s commitment to growing minority and women-owned businesses and increasing diversity in businesses and within the Illinois economy. Through the ADME program, we offer resources to high-potential minority entrepreneurs and provide start to finish support to help them grow their businesses. Interested business owners and aspiring entrepreneurs can receive focused business education and potential access to capital to get their business off the

ground.

Advantage Illinois – FAME Program

Advantage Illinois’ new FAME Program (“Fund for the Advancement of Minority Enterprises”) is a dramatic upgrading of our former Minority/Women/Disabled/Veteran Participation Loan Program. Though still structured as a Participation Loan Program, this new Fund underlines the State’s promise to focus on fostering new and expanding small business entrepreneurship among minority and women-owned businesses. The FAME Program, funded by “Recycled SSBCI Funds”, will provide 50% of the entrepreneur’s overall Project Cost of the specific Loan that DCEO is participating in, up to a maximum of $400,000 of AL Funds, with a fixed interest rate on the Advantage Illinois portion set at 2%.

Illinois Office of Minority Economic Empowerment

555 W. Monroe, 12th Floor Chicago, IL 60661

Website: www.illinois.gov/dceo Email: OMEE@illinois.gov

Chicago contact: Sacella Smith Sacella.Smith@Illinois.gov

Employee Retention Tax Credit (ERC)

Employee Retention Credit

Businesses Have Until 2024 to Claim the Employee Retention Credit Retroactively

CARES ACT – 2020 / Consolidated Appropriations Act – 2021 / American Rescue Plan Act – 2021

ERC is a payroll tax refund born out of the same COVID relief bill as PPP, which incentivized businesses who kept employees on payroll during the pandemic. Originally, companies were limited in their ability to claim either the PPP or ERC, but not both. In early 2021, the rules changed and your business can claim ERC even if you received PPP funds.

Our current thoughts:

- This could be a considerable amount of money, so you should spend some time on this.

- You have until 2024 to file an amended tax return

- Confer with your current accountant on their knowledge and experience with the ERC

- Check with your payroll processor. Most payroll processors offer ERC assistance. They are the ones with the payroll data you need for your ERC application.

There has been a barrage of advertisements from various parties that offer to assist with completing the forms. Watch closely most are asking for 15% – 25% of the take. See below there was an IRS bulletin issued last week warning of scams.

With the 2020 ERC publication, the IRS said if you received PPP reimbursement then you were not eligible for ERC. With the 2021 publication, the IRS clarified its position that essentially you can not “double dip” if you received PPP reimbursement for an employee’s wages, and could not also receive ERC for those same wages. If half of the employee’s wage was reimbursed by PPP, then you could apply for ERC for the other half. Again can’t double-dip.

The scam is a service works up that you have $100,000 in ERC wages they apply for you. You’ll receive from the IRS your $100,000. You turn around and write a check to the service for $25,000(25%). Then later the IRS audits you to find the service did not consider you had received PPP reimbursement for that same $100,000. The IRS wants their $100,000 back. It is now a year down the road and the service is no where to be found to retrieve the $25,000 cut you had paid them.

Good reason to stick with your accountant and/or payroll service, not likely they are going to disappear on you. If you receive ERC you’ll need to resubmit an amended 2020 & 2021 tax return. Actually, a pretty big deal because if your P&L changes your profitability could change which affects your taxes due along with K-1s to your partners. It is a big deal amending tax returns, which then costs accountant fees. So the accounting community is hoping the IRS revises how the ERC is booked. Instead of reducing your wage expense in 2021, therefore changing your profitability, why not record the ERC disbursement as additional income in the year that it is received. And so not having to amend prior tax returns.

Again the deadline is in 2024, so don’t feel pressured. Getting money sooner is always a good thing.

Oct 19th IRS Bulletin: Employers warned to beware of third parties promoting improper Employee Retention Credit clams. HERE

Illinois Restaurant Association ERC Webinar 10:00am Thursday Oct 27th

Register HERE

Some of the Details, warning the weeds get thick

Credit amount

The total ERTC benefit per employee can be up to $26,000 ($5,000 in 2020 and $7,000 per quarter in 2021).

- For 2020, an eligible employer is entitled to a refundable credit equal to 50% of qualified wages paid from March 13, 2020, through December 31, 2020, plus qualified health plan expenses (up to $10,000 in qualified wages per employee, resulting in a maximum credit of $5,000).

- For 2021, an eligible employer is entitled to a refundable credit equal to 70% of qualified wages paid from January 1, 2021, through September 30, 2021 (up to $10,000 in qualified wages per employee per quarter, resulting in a maximum credit of $7,000 per quarter).

- Recovery Startup Businesses could be eligible to take a credit of up to $50,000 for the third and fourth quarters of 2021 since they were eligible through the end of 2021.

What is the Employee Retention Credit?

The ERC is a refundable credit that businesses can claim on qualified wages, including certain health insurance costs, paid to employees.

Businesses can no longer pay wages to claim the Employee Retention Tax Credit, but they have until 2024 to do a look back on their payroll during the pandemic and retroactively claim the credit by filing an amended tax return.

Although the Employee Retention Credit (ERC) program has officially sunset, this does not impact the ability of a business to claim ERC retroactively. In fact, businesses have up to three years from the end of the program to conduct a lookback to determine if wages paid after March 12, 2020 through the end of the program are eligible.

For most businesses, the credit could be claimed on wages until Sept. 30, 2021, with certain businesses having until Dec. 31, 2021 to pay qualified wages.

Employer Eligibility

Your business could be eligible in one of two ways:

- It was fully or partially suspended due to a governmental order limiting commerce, travel or group meetings related to COVID-19.

- It experienced a significant decline in gross receipts, as defined by more than 50% in 2020 and more than 20% in 2021.

Qualified wages

The ERC uses wages and/or health plan expenses to calculate the respective benefit.

For 2020:

- For eligible employers that had an average number of full-time employees in 2019 of 100 or fewer, all wages paid to employees during the eligible period(s) may count toward the ERC.

- For eligible employers that had an average number of full-time employees in 2019 of greater than 100, wages paid for time not providing services due to a full or partial suspension by governmental order or the business experiencing more than a 50% decline in gross receipts for a calendar quarter when compared to the same quarter in 2019 may count toward the ERC.

For 2021:

- For eligible employers that had an average number of full-time employees in 2019 of 500 or fewer, all wages paid to employees during the eligible period(s) may count toward the ERC.

- For eligible employers that had an average number of full-time employees in 2019 of greater than 500, wages paid for time not providing services due to a full or partial suspension by governmental order or the business experiencing more than a 20% decline in gross receipts for a calendar quarter when compared to the same quarter in 2019 may count toward the ERC.

Claim the Credit Even if Your Business has Already Benefited from the Following:

CARES Act – 2020

For employers who qualify, including borrowers who took a loan under the initial PPP, the credit can be claimed against 50 percent of qualified wages paid, up to $10,000 per employee annually for wages paid between March 13 and Dec. 31, 2020.

Consolidated Appropriations Act – 2021

Employers who qualify, including PPP recipients, can claim a credit against 70% of qualified wages paid. Additionally, the amount of wages that qualifies for the credit is now $10,000 per employee per quarter.

American Rescue Plan Act – 2021

The credit remains at 70% of qualified wages up to a $10,000 limit per quarter so a maximum of $7,000 per employee per quarter. So, an employer could claim $7,000 per quarter per employee through the first three quarters of 2021 after the passage of the Infrastructure Investment and Jobs Act changed the end date of the program for most businesses. However, Recovery Startup Businesses were eligible through the end of 2021. They could be eligible to take a credit of up to $50,000 for the third and fourth quarters of 2021.

Advancing Black Pathways - Chase Bank Accelerator

Our Advancing Black Pathways (APB) team is excited to announce that the application for the Black Professional Entrepreneurs Resurgence® Accelerator Program sponsored by JPMorgan Chase is open! This is an incredible opportunity for Black service professional business owners in the Chicagoland area to receive comprehensive support, strategic guidance, and valuable resources to accelerate the growth of their businesses.

Program Overview:

The Resurgence® Program is a dynamic accelerator designed to empower Black-owned businesses with the tools, knowledge, and network needed to achieve sustainable success. Through a series of interactive workshops, expert-led sessions, and tailored mentoring, participants will gain insights into various aspects of business growth, from strategic planning and operational finance to leadership development and marketing strategies.

Key Program Highlights:

– Increase Bankability

– Strengthen business capacity

– Enhance Supplier readiness

– Network and community development

– Strategic planning for sustainable growth

– Operational business development training

– Leadership development and professional growth

– Marketing and branding strategies

– Access to expert-led sessions and subject matter experts

To learn more about the program, please find attached our Resurgence® Accelerator Program One-Pager.

Application Details:

– Applications Closed: October 5, 2023

– Applications can be accessed HERE

Learn More About Advancing Black Pathways Here

Founders First CDC

FOUNDERS FIRST CDC CHICAGO JOBS CREATOR GRANT

a leading business accelerator program in the country for diverse-led companies.

Application Deadline February 6th 2024

A total of $100,000 will be awarded to 25 businesses in Chicago.

Grants are a great way to receive growth capital for your small business. With a simple application, you can receive cash and a full tuition scholarship to one of our stellar accelerators. Hear first hand from grant recipients and partners.

- Grant money can be used as growth capital to hire or rehire premium wage jobs.

- Cash infusion can be used to purchase, fix or enhance equipment necessary to help you manage growth challenges and scale for the future.

- Founder identify as one of the following: Latinx, Black, Asian, Women, LGBTQIA+, Military Veteran, or located in a Low to Moderate Income area.

- TO QUALIFY: Must be located in the state of Illinois and have a current staff of 2-20 employees. Will have the ability to add 1-2+ net new premium wage jobs in the next 12 months. Your company must be a service-based business and at least one revenue stream serving other businesses. Must be a for-profit company with annual revenues between $100K and $3 million.

The application deadline is February 6, 2024. Please email us at socal.jobcreators@foundersfirstcdc.org with any questions about the Job Creators Quest Grant.

Please visit the Grant FAQ page for more information.

American Express Main Street Grants

American Express Backing Small Businesses 2024 Initial Grant $10,000

Deadline April 7th

$10,000 grants some $30,000. In partnership with American Express, the Backing Small Businesses grant program supports economically vulnerable and under-resourced small businesses with community reach and/or cultural significance. This year, eligible small business owners can apply for $10,000 grants for projects that grow or improve their businesses by building community, supporting their economic viability, or bolstering meaningful change.

Goldman Sachs Programs

Goldman Sachs 10,000 small business program